Irs penalty and interest calculator

Links and information for your state taxes. IRS Penalty Interest Rates.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties.

. To use this calculator you must enter the numbers of days late the amount of the invoice in which payment was made late and the Prompt Payment interest rate which is pre-populated in the box. Information on new and changing tax laws. At wwwirsgov you can find.

This means the IRS requires you to pay estimated taxes throughout the yeareither via withholding from paychecks or by making. In the US federal income taxes are a pay-as-you-go system. Send us a payment or pay your taxes in full to stop future penalties and interest from adding up.

The date from which we begin to charge interest varies by the type of penalty. The IRSInternal Revenue Service can slap you with an underpayment penalty if you fail to make the full estimated tax payments. If a payment is less than 31 days late use the Simple Daily Interest Calculator.

It increased a full percentage point from the third quarter of 2022 and 3 from Q4 2021. Sample Penalty Relief Letter. The IRS doesnt pay old refunds.

During its processing the IRS checks your tax return for mathematical accuracy. 5 for large corporate underpayments. The provided calculations do not constitute financial tax or legal advice.

This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on tax debt. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. Tax and additions due Due Date.

Forms worksheets and publications needed to complete your return. If a payment is more than a month late use the Monthly Compounding. The IRS sets the rate each quarter at the federal short-term rate plus three percentage points.

When processing is complete if you owe any tax penalty or interest you will receive a bill. About Alert messageserrors will be displayed here. Confirm your e-mail address.

The penalty is essentially an interest charge. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. You can only claim refunds for returns filed within three years of the due date of the return.

Our IRS Penalty Interest calculator is. The following COVID information was for 2020 Returns. 3 for overpayments 2 in the case of a corporation.

Calculate interest the CRA charges on tax debts owed to it. The interest rate is determined quarterly and is the. The provided calculations do not constitute financial tax or legal advice.

Everything before that is lost. For more information about the interest we charge on penalties see Interest. The IRS interest and penalty calculator calculates the penalty amount on the basis of your filing status income quarterly tax amount and deduction method.

Lost IRS check 800-829-1954. IRS interest rates will remain unchanged for the calendar quarter beginning April 1 2021. Recommends that taxpayers consult with a tax professional.

The rates will be. Penalty Calculator Interest Calculator Deposit Penalty Calculator Tax Calculator. Customer service 800-829-1040.

The interest rate for underpayments by individual taxpayers for the fourth quarter of 2022 is 6. Online tools and calculators. Confirm that the IRS is looking for only six years of returns.

Generally interest accrues on any unpaid tax from the due date of the return until the date of payment in full. To contact the IRS call. Interest increases the amount you owe until you pay your balance in full.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The Complexities Of Calculating The Accuracy Related Penalty

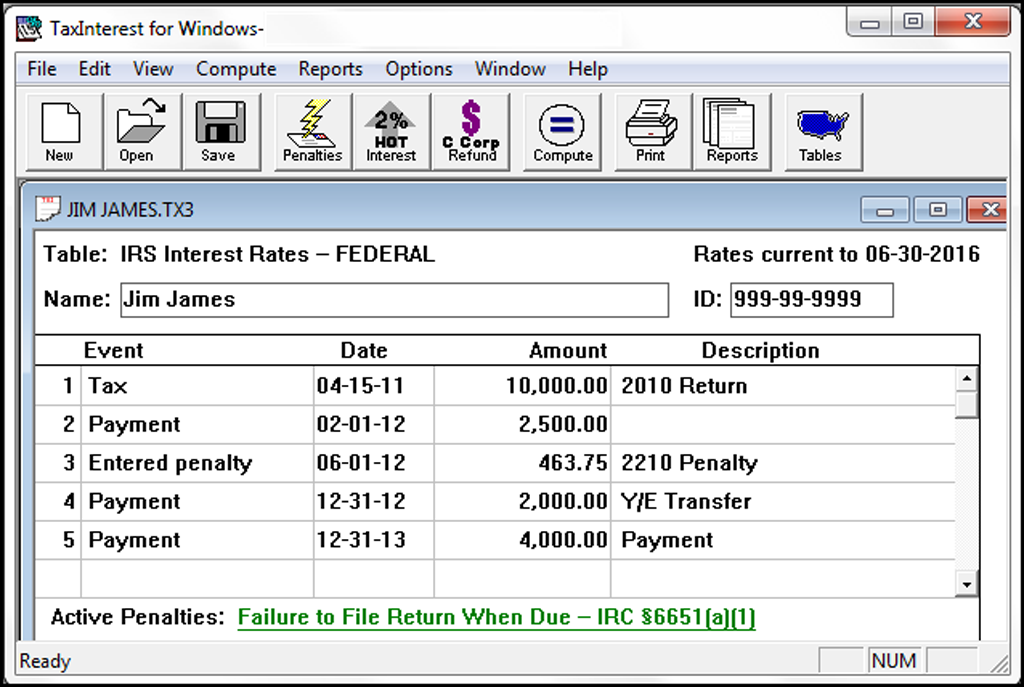

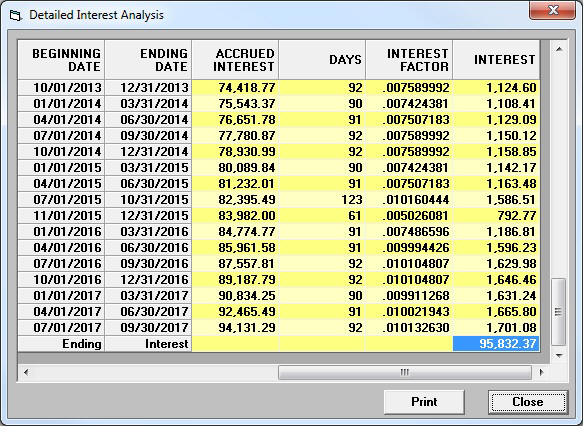

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator Tax Software Information

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Easiest Irs Interest Calculator With Monthly Calculation

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

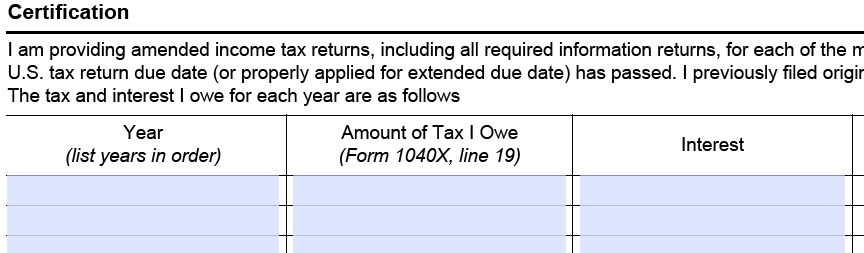

Form 14654 Form 14653 Interest Calculator

Taxinterest Products Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax